Happy Thanksgiving peeps!

Dallas Cowboys = scrubs

Redskins = 1 point less than scrubs … [Read more...]

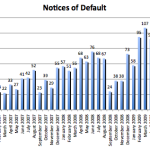

Big Bear Foreclosure Numbers – October 2009

Foreclosure filings in Big Bear were up 10% in October 2009 when compared to the previous month. Year over year, foreclosure filings were up 70% from the October 2008 numbers. New notices of sale shot up in October, showing that banks are still moving forward on foreclosures, while new notices of default and Trustee sales remained relatively the same. Keep in mind, foreclosure filings are made up of three parts - Notices of Default (NOD), a recorded document that starts the foreclosure process, which is filed … [Read more...]

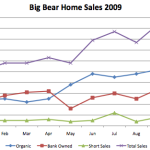

Big Bear Home Sales – October 2009

Big Bear Home Sales For the second month in a row, Big Bear home sales are near their two year high. Home sales in October were down 3 % when compared to the September sales (94 v. 92), but were up 26% when compared to the same month last year (92 v. 73). June thru October have been the strongest selling months we've seen during this down market. While it is still a lot slower than the middle part of the decade (we were selling 150-300 homes per month then), and this is typically the busiest time of the year … [Read more...]

Big Bear Bank Owned Homes – Assumptions Are Not Always True

There are a lot of assumptions about buying bank owned properties in Big Bear. Here are a couple that I see a lot. 1. Banks or REO sellers will take a lot less than the list price. 2. The listing price for a bank owned property is going to be aggressive. Click here to see embedded video. The fact is bank owned homes in Big Bear are selling closer to the list price than organic sales, 97% vs. 95%. Many times, banks will price their properties so aggressive that they receive multiple offers that go over full … [Read more...]

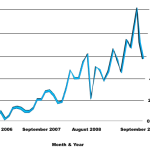

Sunday Stats For The Big Bear Real Estate Market

If you have not already been able to tell, I am a fan of charts and graphs as I think they give you a good visual of how the real estate market in Big Bear is performing. And, it was a quiet day today so I had some time to crunch the residential market stats for Big Bear this year. First off, home sales in Big Bear for 2009 through October. Some key takeaways - Bank owned properties dominated what was selling in the first quarter of the year, but have since dropped off When the total sales dropped, organic … [Read more...]

Big Bear Foreclosure Numbers – September 2009

Bank repossessions in Big Bear were up 9% in September though the overall foreclosure filings dropped significantly. The foreclosure filings in September 2009 (180) were down 18% from August 2009 (219). Year over year, however, filings were up 122% from the September 2008 (81) numbers. Good news - we are seeing a slow down in the foreclosure numbers. Bad news - the numbers are still too high to be overly excited about the market getting better. Foreclosure filings are made up of three parts - Notices of … [Read more...]

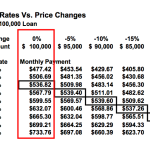

Should I Price It Firm Or Flexible?

This question inevitably comes up every time when I am talking with sellers about their asking price. And the most common statements or questions I hear relating to this are - "We don't want to give it away" "Let's start higher, we can always go down, can't go up." "Buyers are going to want to low-ball the price, so why not leave some room?" My recommendation to sellers is always to price firm, regardless. I understand not wanting to give it away. In fact, I've never met a seller that wants to give their … [Read more...]