With the slowing of COVID, we have had numerous requests for a market update comparing the real estate frenzy of the past few years with today’s more normalized market. Simply put, the markets of 2020 and 2021 were unprecedented. Given that, those are not market periods we would usually compare to the more typical trends that have occurred in the last 20-30 years. To get a more realistic idea of where the market currently stands in comparison to the recent past, for today, I’ll be covering 2019 through today.

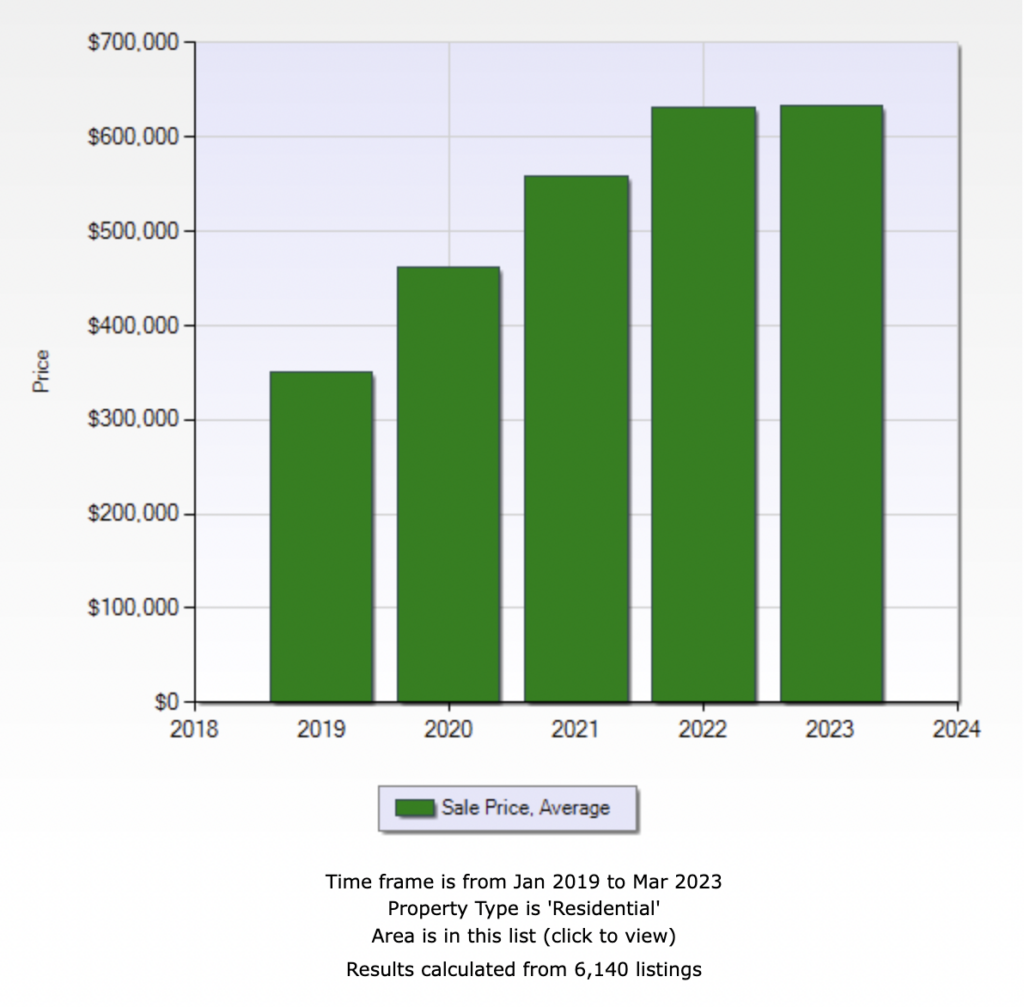

As expected, price is the primary factor people consider when buying or selling. Below is a graph comparing the average sales price from 2019-2022. Keep in mind, high dollar sales will skew these numbers. In 2019 there were only two sales over 2 million with $2,750,000 being the highest sale that year. 2020 we saw a new residential record of $3,699,000 only to be topped in 2021 with the first sale over 4 million at $4,750,000. 2022 had 4 sales over 4 million and obtained the new record at $4,800,000. A huge new record may come in 2023, as 205 Lagunita Lane is currently in escrow with a list price of $5,895,000.

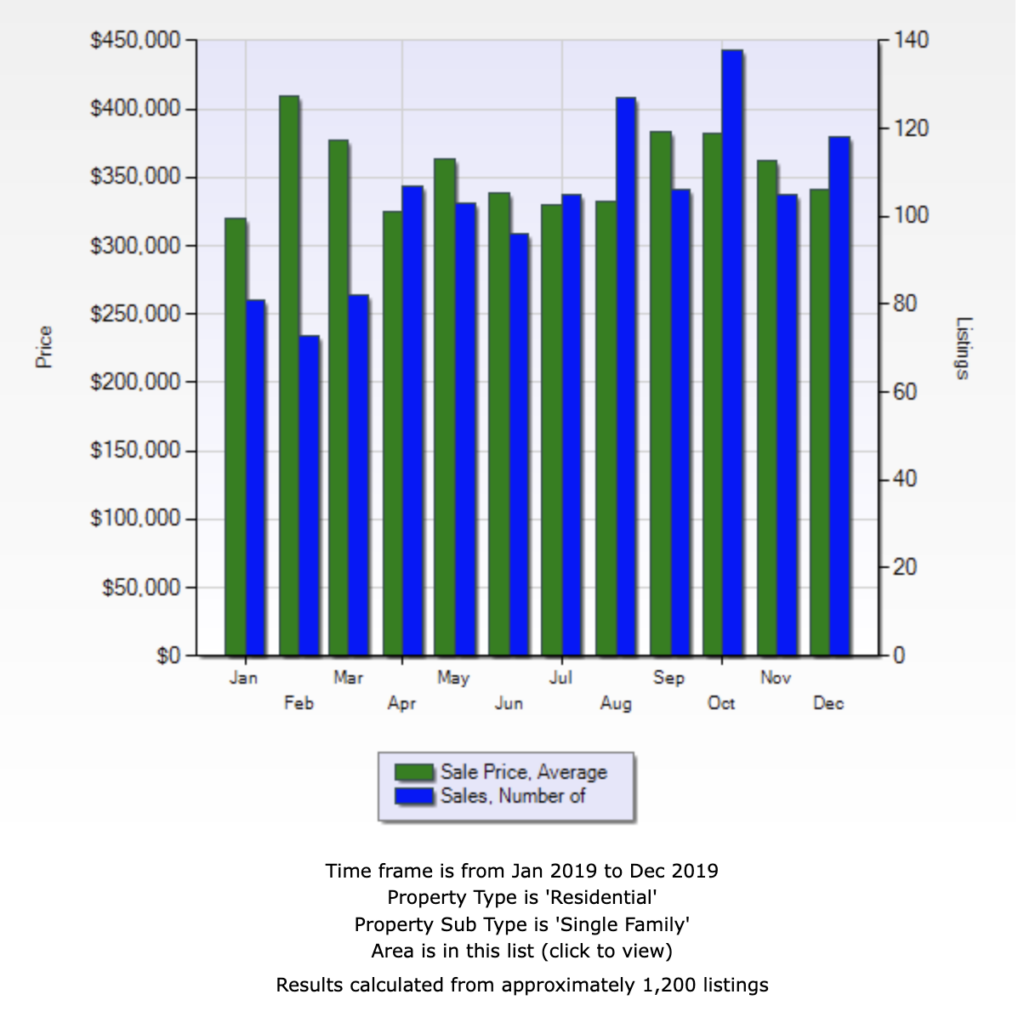

2019 showed typical trends in place since the 2008 great recession. Prices increased at the normal 4-5% annual average and recorded sales were comparable to recents years with 1297 homes sold during the year. For a more detailed reference, the graph below reflects the average sales price and number of sales for each month of 2019. The average cumulative days on market (list to close) was 125 and sales price was $350,000. Closed to list price ratio was an average of 98%. For the year, 2019 mortgage rates began to fall after increasing the previous year. The rate in January was 4.5% and fell to 3.7% by December.

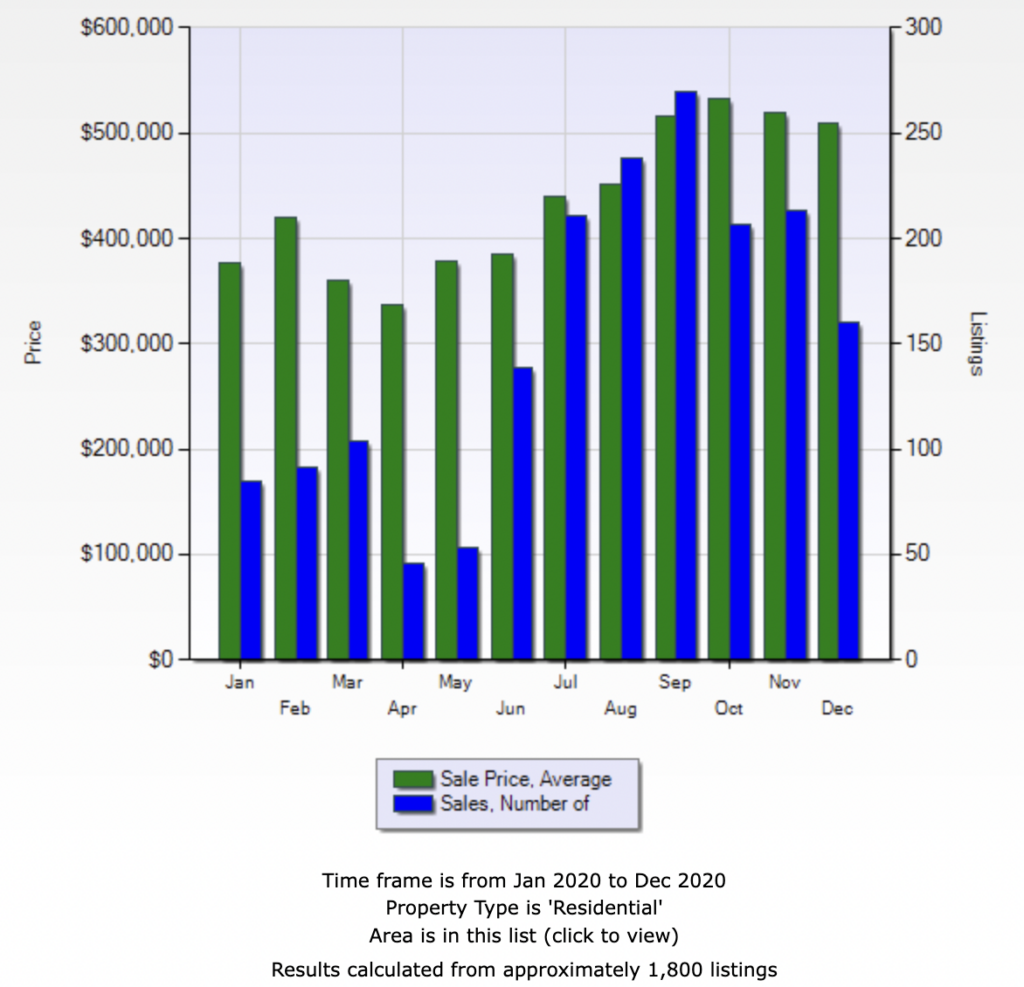

For the year 2020, while the COVID market trends varied widely worldwide, our local market saw drastic changes due to Big Bear’s unique set of circumstances. A huge contributor was our proximity to Southern California’s large population centers (over 20,000,000 in all). Being just 2-3 hours from all major So Cal cities has always made Big Bear easily accessible for those seeking a high alpine, mountain lake experience (compared, for instance, to a 5-6 hour drive to Mammoth). During COVID those travelers, used to boarding planes to other destinations, and no longer had the the ability to do so, flocked to beautiful Big Bear instead. Many of the buyers I sold homes to in 2020 had never (or rarely) visited our community and were pleasantly surprised with what they discovered. Closed sales and prices increased drastically to 1817 homes closed with an average sales price of $475,000. Additionally, interest rates continued to drop. In January rates were at 3.6% and by December hit a record low of 2.6%. Cumulative days on market (CDOM) were 145 in January and fell to 90 days in December. By summer we were accustomed to seeing multiple offers and homes selling as much as $100K+ over list price.

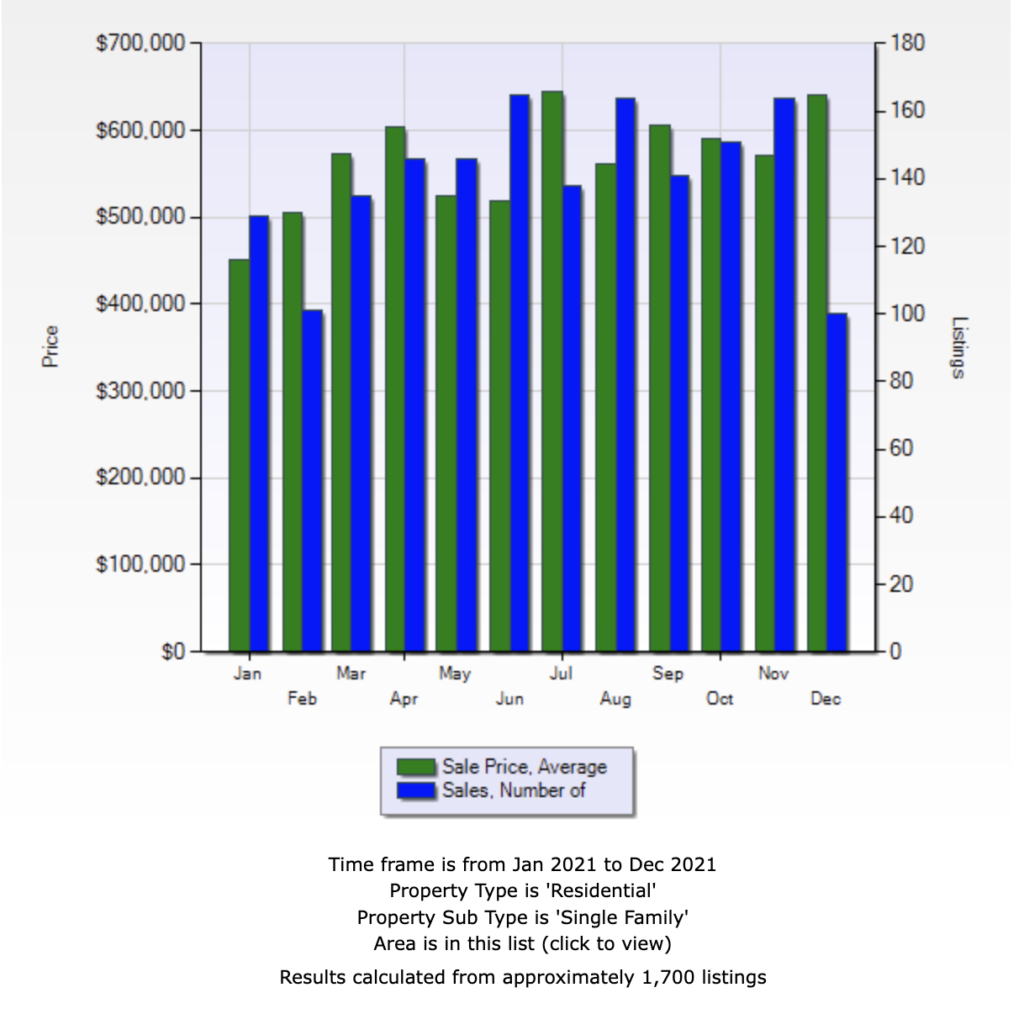

After 2020 we expected 2021 to bring a more normalized market but that quickly proved not to be the case. Closed sales were at 1757 with a huge increase in average sales price landing at $560K. CDOM were their highest in March at 140 days and lowest in July just below 60. Competitive multiple offers were even more common than in 2020 and active inventory slipped to a record low just below 60 listings. Rates remained very desireable throughout the year but began to climb slightly from 2.7% in January and ending at 3.1% in December.

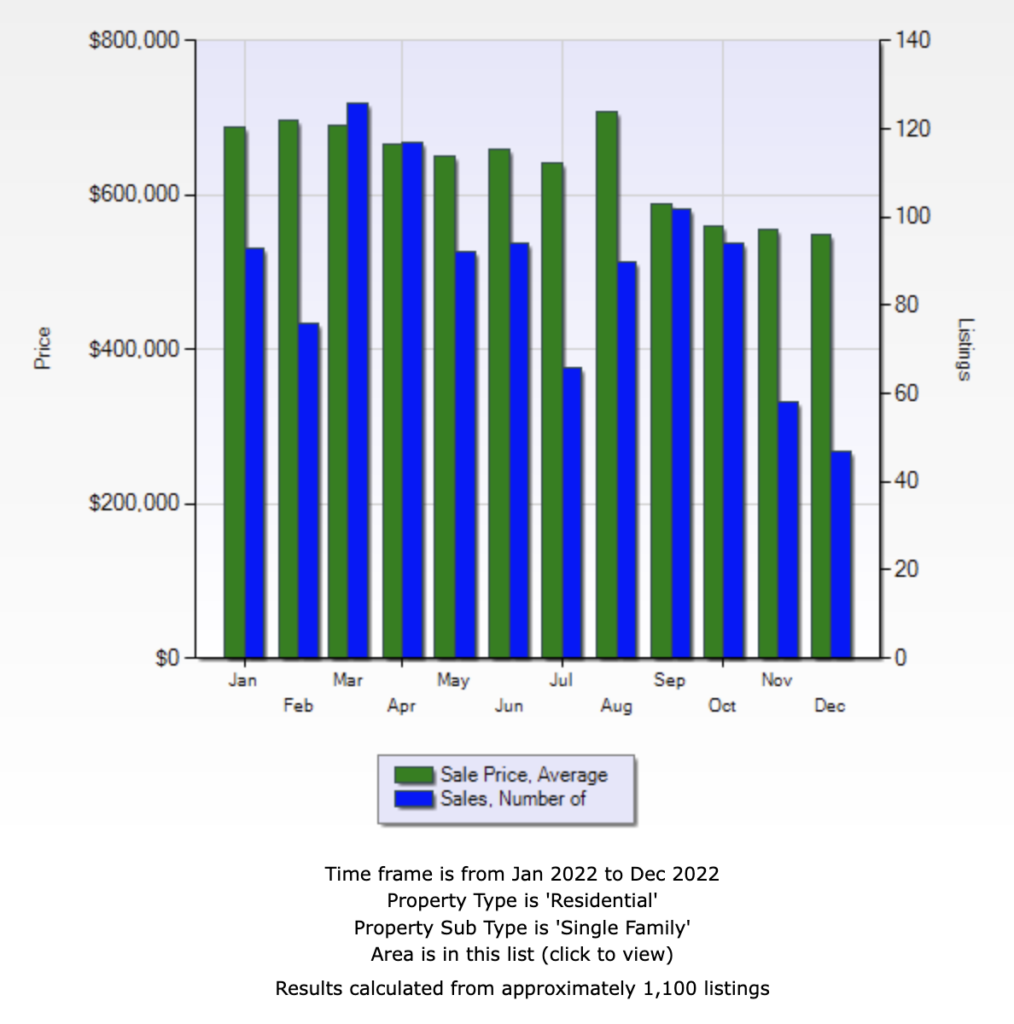

In 2022, we began to see a decline in the number of sales but sales price remained strong with 1127 closed residential sales and an average sales price of $625,000. Of note, 2022 saw records for high dollar sales which drastically increased the year’s overall price average. Average CDOM for 2022 was 85 with May being the lowest average at 60 and December the highest at 110. For the year, rates climbed significantly starting at 3.5% in January and ending at 6.5% in December.

So how has the real estate market started off? As of March 20th, 141 homes have closed escrow. This is considerably lower than the 253 sold this by this time in 2022 and the 221 sold in 2019. There are 193 active homes for sale and 67 in escrow. Thus far, average sales price remains strong at $550,000 and CDOM are at 110. Today’s rate is 6.6% which is .5% higher than February. While the remainder of 2023 remains unknown, some predict that we could see rates start to drop and land between 5-6% by the end of the year. Fortunately, Big Bear has had an abundant, snowy winter which has already increased our lake level by 5 feet since October. With more snow and rain in our forecast before spring kicks in, we will likely begin the summer less than 10 feet from high water. This will likely positively effect lakefront inventory/sales and potentially sales overall.

Speak Your Mind