Foreclosure filings in Big Bear jumped 23% in February 2010 when compared to January. Year over year however, foreclosure filings were down 22% from the February 2009 numbers, the second straight month that foreclosure filings were down year over year.

Keep in mind, foreclosure filings are made up of three parts – Notices of Default (NOD), a recorded document that starts the foreclosure process, which is normally filed after homeowners fall behind in their payments. Notices of Sale (NOS), a recorded document which is typically filed about 3 months after the NOD, which sets the date for the Trustee Sale. Trustee Sales, typically held around 25 days after the NOS is filed, which are made up of properties that go back to the bank or sold to third parties, generally on the court house steps.

In February, Notices of Default jumped back up from previous low, while Notices of Sale & Trustee Sales back to the bank remained near their monthly average.

Here’s how the foreclosure numbers broke down for February 2010.

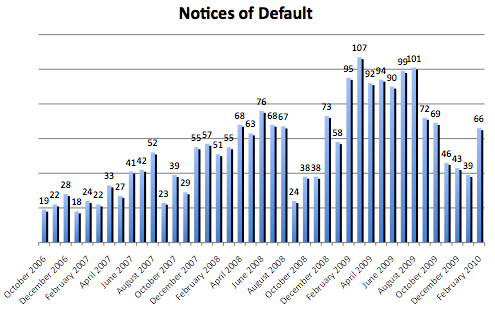

Notices of Default (NOD) – 66 total, up 69% from January and down 31% from February 2009.

After 3 consecutive months of seeing a drop in the NODs, they came back up in February. Year over year, they are down quite a bit. However, February 2009 to August 2009 was the high point for NODs filed, so while we are down, 66 is still a high number for Big Bear. We need to see these numbers down in the single digits, or teens, before we will see the foreclosure market getting better.

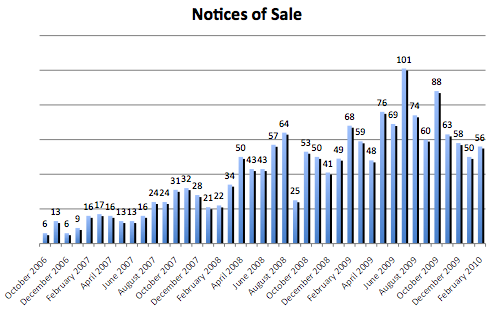

Notices of Sale (NOS) – 56 total, up 12% from January but down 18% from February 2009.

No big news here. We are still seeing a steady flow of new properties being put on the Trustee Sale calendar every month. Whether or not they actually go to sale, or whether they are postponed to a future date, is a different story. But, until the NODs get lower, we should continue to see NOSs in this range every month.

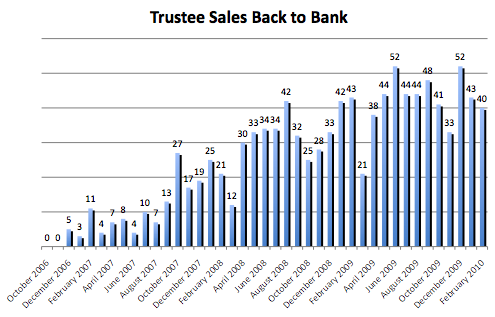

Trustee Sales (properties that went back to bank) – 40 total, down 7% from January and down 7% from February 2009.

Considering 52 was the highest month we’ve seen for this, February is still on the higher end of the scale. I’d expect to see 30-50 properties going back to the bank every month for the remainder of this year.

Want to see what actually happens at Trustee Sales? Check out the video below.

Foreclosure Inventories In Big Bear (aka the Foreclosure Pipeline)

| Feb. 2010 | |

| Preforeclosure (Notice of Default) | 166 |

|---|---|

| Auction (Notice of Sale) | 192 |

| Bank Owned | 175 |

This is something new that I will start to track as it will show where we are now, as compared to where these numbers will be in the future – lower, hopefully.

There still remains a large amount of Big Bear properties in the foreclosure pipeline – 166 properties have an NOD filed against it, 192 a Notice of Sale, and 175 are currently owned by the Bank or Lender. Of those 175 that are bank owned, some are already on the market for sale, some are not, and a small amount have already re-sold to new owners.

Hey Tyler,

Very informative. Thank you so much for posting this!

Thanks Carol.

I post this every month around the 20th or so. It is good to know what is going on with foreclosures in order to see what is coming down the pike.

Hi Tyler!

Thanks. Great monthly information, I look forward to reading. I appreciated the video on a Trustee sale. I have wondred what they were like. It is funny, I actually work near the location in the video, and had passed them before, and wondered what was going on at the court! In fact yesterday I passed them again yesterday – and this time knew what was happening. It definitely helped to visualize the process. I can understand the risks if you have not done your homework, and thus why there aren’t to many sales at Trustee sales.

–Linda

Thanks Linda. There are several risks with buying at the Trustee sales, not to mention they are all cash, as is sales. That said, we patience and good research, there is money to be saved at these sales.