Foreclosure filings in Big Bear dropped significantly in May 2010, down 32% when compared to April. And year over year, foreclosure filings were down 46% from the May 2009 numbers, the fifth straight month that foreclosure filings were down year over year. This is a welcome sign for an otherwise slow moving Big Bear real estate market.

Keep in mind, foreclosure filings are made up of three parts – Notices of Default (NOD), a recorded document that starts the foreclosure process, which is normally filed after homeowners fall behind in their payments. Notices of Sale (NOS), a recorded document that is filed about 3 months after the NOD, which sets the date for the Trustee Sale. Trustee Sales, typically held around 25 days after the NOS is filed, made up of properties that go back to the bank or sold to third parties, generally on the court house steps.

In May, all three – Notices of Default, Notices of Sale, & Trustee Sales back to the bank – dropped considerably.

Here’s how the foreclosure numbers broke down for May 2010.

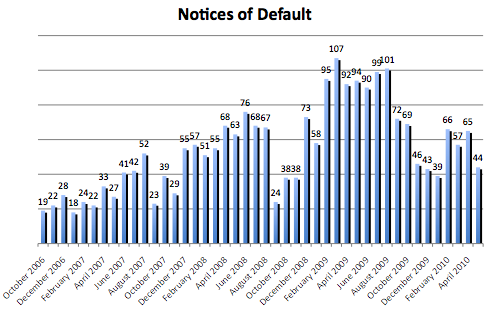

Notices of Default (NOD) – 44 total, down 32% from April and down 53% from May 2009.

This is a big drop compared to what we were seeing a year ago. If it continues, great, as it would mark the beginning of the end of foreclosures hitting the market. But, it is too early to tell that right now. We need to see consistent, sub-20 NODs per month in order to turn the corner in my opinion.

Why are defaults slowing? Good question. Could be one of several things. 1. Homeowners are not falling behind anymore – may be true but unlikely. 2. Banks are slower to file the Notices – more likely. We’ll see in the coming months.

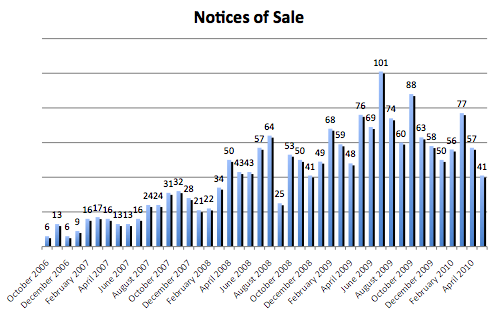

Notices of Sale (NOS) – 41 total, down 28% from April and down 46% from May 2009.

Similar to NODs, these numbers are down dramatically year over year. Even still, the number of homes in Big Bear currently in the NOS foreclosure pipeline is just 1 less than last month. So, while we have seen a drop in the Notices filed, the total number on the verge of going to sale is nearly the same (see below).

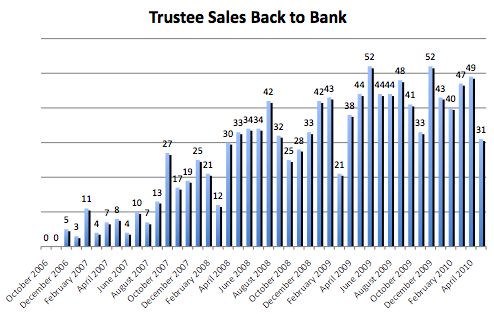

Trustee Sales back to bank – 31 total, down 37% from April and down 24% from May 2009.

This is the lowest we’ve seen since November 2009, another good sign. Less properties going to back to the bank means less coming on the market, and less downward pressure on pricing.

What are reasons properties never go back to the bank? I know of several – 1. the homeowner cures the defaulted amount; 2. the homeowner modifies their loan; 3. the homeowner completes a short sale; 4. a third party buys the property at the trustee sale on the court house steps (these eventually come on the market as investor owned); or 5. the lender incorrectly filed the foreclosure paperwork and has to start over.

Want to see what actually happens at Trustee Sales? Check out the video below.

Foreclosure Inventories In Big Bear (aka the Foreclosure Pipeline)

| Feb. 2010 | Mar. 2010 | April 2010 | May 2010 | |

| Preforeclosure (Notice of Default) | 166 | 187 | 189 | 169 |

|---|---|---|---|---|

| Auction (Notice of Sale) | 192 | 186 | 168 | 167 |

| Bank Owned | 175 | 179 | 167 | 148 |

Though lower than last month, there still remains a large amount of Big Bear properties in the foreclosure pipeline – 169 properties have an NOD filed against it, 167 a Notice of Sale, and 148 are currently owned by the Bank. Of those 148 that are bank owned, some are already on the market for sale, some are not, and a small amount have already re-sold to new owners. All in all, month over month, the foreclosure inventory in Big Bear is down 8% from last month.

Why are these numbers important? In my opinion, they are the most important stat to keep track of as they offer a glimpse into the future of any market. Everyone knows that foreclosures bring prices down in neighborhoods. So, the more foreclosures in an area, the more the downward push on pricing. And, if we want the market/prices to get better, we need to get all of these properties through the foreclosure pipeline first.

Til next month…..

Speak Your Mind