Foreclosure filings for Big Bear dropped in October 2010, down 17% when compared to September, a sizable chunk which continues the zig-zag movement of the Big Bear foreclosure market over the past year. Year over year, foreclosure filings were down 33% from the October 2009 numbers, the tenth straight month that foreclosure filings were down year over year.

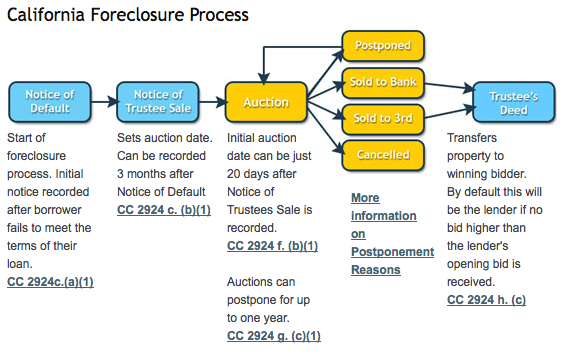

Foreclosure filings are made up of three parts – Notices of Default (NOD), a recorded document that starts the foreclosure process, which is normally filed after homeowners fall behind in their payments. The timing of when the lender files this can vary from the 1 month to over 12 months, depending upon how aggressive they want to be and the new rules they must follow. Notices of Sale (NOS), a recorded document that is typically filed between 3-6 months after the NOD, which sets the date for the Trustee Sale. Trustee Sales or auction, typically held around 25 days after the NOS is filed, is made up of properties that go back to the bank, generally on the court house steps.

Trustee sales have only three possible outcomes – the property goes back to the bank (which is most common); the property is bought by a 3rd party (typically investors), those who buy the properties at the trustee sales instead of it going back to the bank; and properties that are canceled, or pulled from sale.

Here’s how the foreclosure numbers broke down for October 2010.

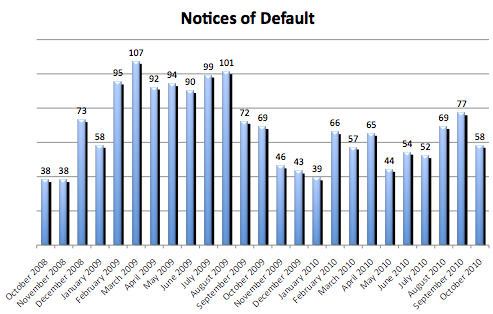

Notices of Default (NOD) – 58 total, down 25% from September and 16% from October 2009.

From the yearly high last month, October was more in line with what we’ve been seeing all year. Keep in mind, this is the start of the foreclosure process, so the majority of these properties won’t be coming onto the market for close to a year or more given the delays.

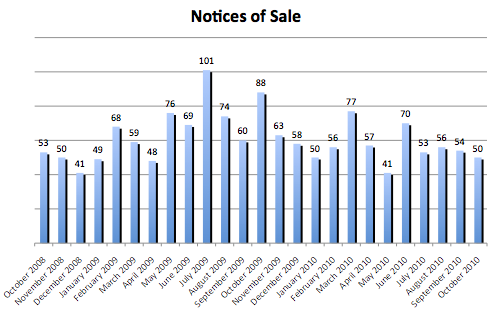

Notices of Sale (NOS) – 50 total, down 7% from September and 43% from October 2009.

Though it was a big drop year over year, this number continues to remain near the yearly average, which means lenders are slowly but surely moving forward with the foreclosure process.

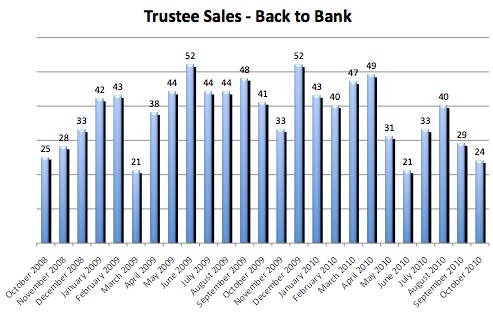

Trustee Sales – Back to the bank – 24 total, down 17% from September and 41% from October 2009.

Again, one of the slower months we’ve seen the past year. Not sure if this low number has to do with the robo-signing and affidavit scandal that hit in mid October or if it is just part of the seasonality. Compared to last year though, it is a lot lower. Expect this number to remain low as we head into the winter holiday season but don’t be surprised to see it ramp back up towards the beginning of the year.

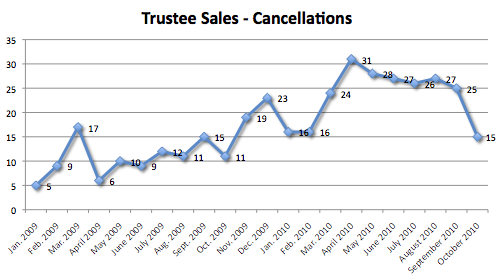

Trustee Sale – Cancellations

After 7 months of elevated cancellations, they dropped down to 15 in October. My suspicion is that a lot of the trustee sales scheduled in October were postponed due to the robo-signing controversy but they will ultimately show up again in future months. The majority of these cancellation never re-file, so the higher the number, the better for the overall market condition as it is taking distressed properties out of the foreclosure pipeline.

What are reasons for these cancellations? I know of several – 1. the homeowner cures the defaulted amount; 2. the homeowner modifies their loan; 3. the homeowner completes a short sale; or 4. the lender incorrectly filed the foreclosure paperwork and has to start over.

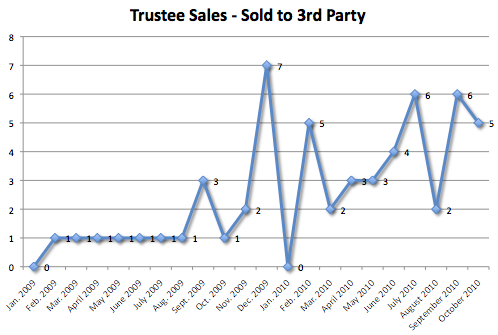

Trustee Sales – Sold to 3rd Parties

5 properties in Big Bear sold to third parties at the trustee sales in October. This number has a direct impact on the properties that go back to the bank as well. The more aggressive the opening bid price at the trustee sales, the more third party sales you will see, and the lower the amount going back to the banks as was evident this past month.

Expect to see this number fall in the 1-10 range over the next year or so.

Buying a property at the trustee sale has a lot of risks – has to be a cash purchase, “as is” with limited to no inspections, no title insurance, eviction possibility, etc. The major reward is the potential to buy a property at well below market value. To those that have the time, skills and patience, trustee sales can be very lucrative. Most of time, these properties will be put back on the market with the investors looking to make a 10-50% return!

Want to see what actually happens at Trustee Sales? Check out the video below.

Direct link to the YouTube video

Foreclosure Inventories In Big Bear (aka the Foreclosure Pipeline)

| Preforeclosure (Notice of Default) | Auction (Notice of Sale) | Bank Owned | |

|---|---|---|---|

| Feb 2010 | 166 | 192 | 175 |

| Mar 2010 | 187 | 186 | 179 |

| April 2010 | 189 | 168 | 167 |

| May 2010 | 169 | 167 | 148 |

| June 2010 | 169 | 169 | 133 |

| July 2010 | 190 | 156 | 121 |

| Aug 2010 | 198 | 153 | 120 |

| Sept 2010 | 205 | 160 | 115 |

| Oct 2010 | 222 | 166 | 117 |

All three categories rose slightly in October. 222 properties have an NOD filed against it (the most we’ve seen all year), 166 a NOS, and 117 are currently owned by the Bank. Of those 117 that are bank owned, some are already on the market for sale, some are not, and a small amount have already re-sold to new owners. All in all, month over month, the foreclosure inventory in Big Bear is up 5% from last month.

Why are foreclosure numbers important? In my opinion, they are the most important stat to keep track of as they offer a glimpse into the future of any market. Everyone knows that foreclosures generally bring prices down in neighborhoods. So, the more foreclosures in an area, the more the downward push on pricing. And, if we want the market/prices to get better, we need to get all of these properties through the foreclosure pipeline first.

Don’t expect that to happen soon. According to this article, shadow inventory is building and we will see a steady stream of foreclosures for several years to come, “It’s not the hurricane hitting the shore, it’s just a long and persistent rain, and that dampens the spirit all the way through.” Keep those rain coats near by.

Til next month…..

Speak Your Mind