Big Bear Home Sales

Sorry I’ve been so late on posting these. To say things are busy right now in the Big Bear real estate market would be a huge understatement.

So, here we go.

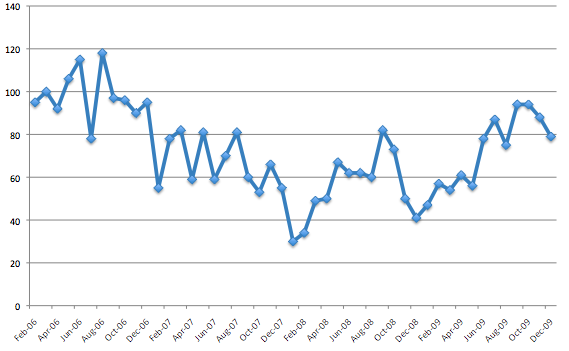

Big Bear home sales slipped a bit in December but overall still remain strong.

Home sales in December were down 10% when compared to the November sales (79 v. 88), but were up 93% when compared to the same month last year (79 v. 41).

The second number really shows you how much better sales are doing this year compared to last year. See the chart at the very bottom for the historical sales numbers for the past two years.

26, or 33%, of the 79 home sales in Big Bear were bank owned, about 2% more than last month. That number has been consistently in the 30-40% most of the year. Earlier in the year, bank owned sales in Big Bear made up closer to 40-50% of the total sales.

8 of the sales, or 10%, were short sales, which is also 2% more than last month. I do expect short sales to make up more of the closed sales this year. The Federal government has got more involved over the past few months, instituting a short sale protocol that banks will need to follow. This will make the process a lot shorter. And with more banks willing to cooperate, it will make the short sale process go smoother. Currently, 35%, or 66, of the total amount of properties under contract/in escrow in Big Bear are short sales.

43, or 58%, of the sales in December 2009 were “organic”, or traditional sellers – a decrease of a few percentage points from last month.

Bank owned properties currently make up only 9% of what is for sale in Big Bear, yet they make up between 30% to 40% of what is selling every month. Conversely, organic sellers make up 82% of what is for sale and only 50% to 60% of what is selling. Short sales are pretty much a wash right now, making up 8% of the total inventory for sale, and 8% of what is selling.

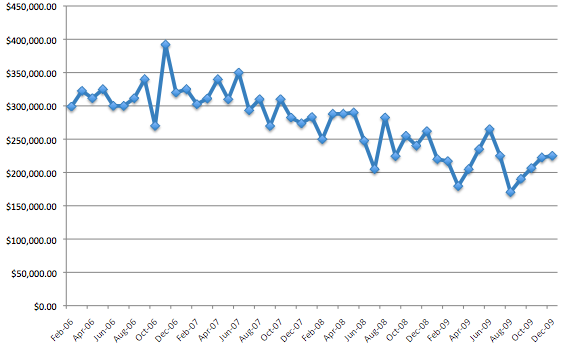

Big Bear Home Prices

The median sales price in December 2009 was on the rise for a fourth straight month, albeit very small increases. It rose just 1% from the November number ($225,000 vs. $222,450). It is down 14% however, from the December 2008 median ($225,000 vs. $262.000). This still goes to show that even while sales are picking up, much higher than 2008 and 2007, the prices are still lower in Big Bear.

I still believe prices on the lower end, under $300,000, have hit their bottom.

One reason for the increase sales might be that sellers are starting to get more realistic with their asking prices. For the first time in more than two years, the median asking price is below $290,000. However, there still remains $65,000 difference in the median sales price of $225,000 and the median asking price of $289,900. This number is getting smaller and smaller. The closer these two get, the more sales we will continue to see.

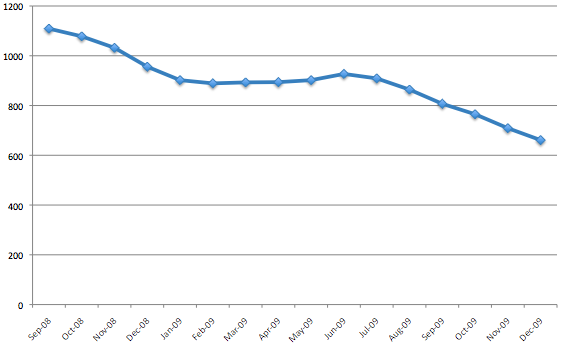

Homes Currently on the Market

The number of homes for sale in Big Bear dropped another 7% from the November number. Year over year, it is still down 31%.

There are less homes for sale in Big Bear now than in any time in the past 3-4 years. If you are a buyer, prices may be low, but options are becoming more limited. With limited options means more competition from other buyers, especially with the good properties. Expect multiple offers and lots of interest on anything considered desirable.

This offers a very unique opportunity for sellers – if you can price your property aggressively, and make it stand out online, you will have buyers lined up. Yeap, that’s right. We are seeing multiple offers on lots of properties right now because they stand out from the rest. As a seller, if you are not getting any activity on your home, make sure the price is in line, your home shows well, and your property is all over the internet. Do this and I guarantee you will sell in this market.

Big Bear Home Sales – Thru December 2009

| Month and Year | # Homes For Sale | Median Asking Price | # Homes Sold | Median Sales Price |

|---|---|---|---|---|

| Dec 2009 | 661 | $289,900 | 79 | $225,000 |

| Nov 2009 | 709 | $299,900 | 88 | $222,450 |

| Oct 2009 | 765 | $299,900 | 94 | $206,500 |

| Sept 2009 | 807 | $310,000 | 94 | $190,358 |

| Aug 2009 | 864 | $313,000 | 75 | $170,400 |

| July 2009 | 909 | $309,000 | 87 | $225,000 |

| June 2009 | 927 | $310,000 | 78 | $265,000 |

| May 2009 | 902 | $316,000 | 56 | $235,000 |

| April 2009 | 894 | $300,000 | 61 | $205,000 |

| Mar 2009 | 893 | $299,950 | 54 | $179,500 |

| Feb 2009 | 889 | $309,000 | 57 | $217,000 |

| Jan 2009 | 902 | $319,000 | 47 | $220,000 |

| Dec 2008 | 956 | $320,905 | 41 | $262,000 |

| Nov 2008 | 1032 | $325,000 | 50 | $240,287 |

| Oct 2008 | 1078 | $329,000 | 73 | $255,000 |

| Sept 2008 | 1109 | $328,500 | 82 | $224,500 |

| Aug 2008 | 60 | $282,500 | ||

| July 2008 | 62 | $205,000 | ||

| June 2008 | 62 | $247,500 | ||

| May 2008 | 67 | $290,000 | ||

| April 2008 | 50 | $299,500 | ||

| Mar 2008 | 1082 | $339,950 | 49 | $288,000 |

| Feb 2008 | 1049 | $345,000 | 34 | $249,950 |

| Jan 2008 | 1094 | $339,900 | 30 | $283,250 |

| Dec 2007 | 55 | $273,750 |

I will post the year end and 4th quarter numbers over the next day or so. We already know 2009 will end up about 30% better than 2008 sales numbers, but I will take a look at some other stats as well. Til then, stay warm.

Want more? Be sure to sign up for my email newsletter or RSS feed.

* Note: The charts above are updated on a monthly basis. They represent single family home sales in the Big Bear area, including Big Bear Lake, Big Bear City, Moonridge, Fox Farm, Sugarloaf, Erwin Lake, & Fawnskin. Data courtesy of the Big Bear MLS. These numbers do not include raw land or condos nor does it include homes in the Big Bear MLS that are located out of the Big Bear area or home sales not listed in the Big Bear MLS.

Related Articles

Big Bear Home Sales – November 2009

Speak Your Mind