The number of homes for sale in Big Bear continued its upward rise with no end in site since hitting the trough in February 2010. The median and average sales prices jumped up again after falling in June, while home sales slipped down slightly in July.

The number of homes for sale in Big Bear continued its upward rise with no end in site since hitting the trough in February 2010. The median and average sales prices jumped up again after falling in June, while home sales slipped down slightly in July.

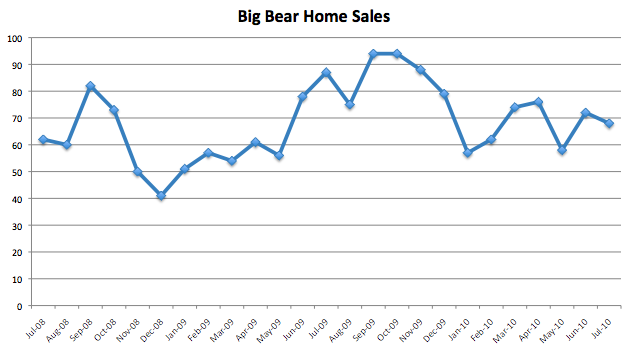

Big Bear Home Sales

Home sales in July were down 6% when compared to the June sales (68 v. 72). Not a huge decrease but would be better for the market if it were 10-20% higher. Compared to last year, sales are down 22% from July 2009 (68 v. 87) 🙁 .

24, or 35%, of the 68 home sales in Big Bear were bank owned, 2% more than last month. 40-50% per month is about the average we’ve been seeing, so this was a another low month for REO sales.

11 of the sales, or 16%, were short sales, which is 2% more than last month. Short sales are slowly but surely gaining some market share. For the last couple years they were always less that 10% of the monthly sales. Maybe we are finally starting to get over the short sale hump. I do expect to see this number get closer to 25-30% over the next year as there are still plenty of seller out there that needs this kind of help. With all the news and hype you hear about short sales, they still make up a small percentage of what sells every month. 80-85% of what is selling in Big Bear is either REO (bank owned) or traditional (organic) sellers.

33, or 49%, of the Big Bear home sales in July 2010 were organic, or traditional sellers – a decrease of 3% from last month. Organic sellers continue to make up over 87% of the available inventory for sale, yet only about half of what is selling every month. Buyers are more attracted to the bank owned and short sale properties as they believe that is where the deals can be found. Most of the time they are right. If you are a traditional seller, you’ve got to compete with the REOs and short sales or else you won’t sell.

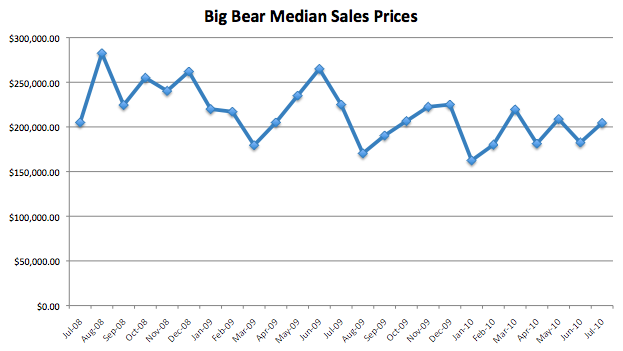

Big Bear Home Prices

The median sales price was up from $182,500 in June to $204,450 in July, a 12% increase. This number continues to bounce around between $160,000 and $220,000. Year over year, the median sales price was down 9% from the July 2009 median. Still a lot of volatility out there in the market when it comes to prices – all over the board.

The average sales price for homes sold in July 2010 was $258,545, up 4% from the June number of $249,756. Year over year, however, the average sales price is down 9% from the July 2009 average price of $280,787.

It is still pretty unpredictable when it comes to Big Bear home prices. But, a continued lower percentage year over year, as was the case this month, would be a welcome sign in answering the question of what is happening with home prices.

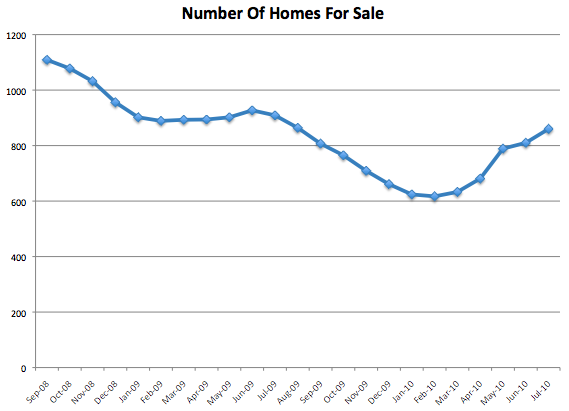

Homes Currently on the Market

The number of homes for sale in Big Bear is still rising. Since February, the number of homes on the market has gone from 617 to 860, a 40% increase. This is nothing too out of the ordinary as we normally see a rise in homes for sale during the summer months. We did not see that last year however, which had a positive impact on keeping the market going with limited options. With higher inventory, the market tends to get a bit sluggish, with prices softening due to more competition and homes sitting on the market longer — good for buyers, bad for sellers.

Month over month, we saw 6% increase (860 vs. 810) in the amount of available properties.

It is also still important to note, however, that the year over year number of homes for sale in Big Bear is still down 5% from July 2009 (860 vs. 909). This margin is getting razor thin, and I’d bet by the end of August it will be pretty close to the same as last year.

Take a look at the graph below – last year at this time we saw a leveling effect, very little gain. Compare that to this year and the rise in homes for sale.

Buyers – the fact still remains that if the one special deal comes up, you have got to move quickly. Though the inventory is increasing, the deals are still going quickly. Every week I see homes come on the market for sales and sell, quickly, for full price or more. That’s reality on the good deals.

Sellers – pricing is still King. You must be the best option available in your price category or else you will just be one of the 800+ that are not selling every month.

Time will tell what is going to happen this summer. Will we get over 1000 homes for sale in Big Bear? Let me know your thoughts.

Big Bear Home Sales – Thru July 2010

| Month and Year | # Homes For Sale | Median Asking Price | # Homes Sold | Median Sales Price | Average Sales Price |

|---|---|---|---|---|---|

| July 2010 | 860 | $299,000 | 68 | $204,450 | $258,545 |

| June 2010 | 810 | $295,000 | 72 | $182,500 | $249,756 |

| May 2010 | 789 | $299,000 | 58 | $208,750 | $255,294 |

| April 2010 | 681 | $289,900 | 76 | $181,250 | $229,149 |

| Mar 2010 | 633 | $279,900 | 74 | $219,500 | $256,236 |

| Feb 2010 | 617 | $285,000 | 62 | $180,000 | $254,124 |

| Jan 2010 | 624 | $298,750 | 57 | $162,500 | $216,260 |

| Dec 2009 | 661 | $289,900 | 80 | $227,500 | $312,925 |

| Nov 2009 | 709 | $299,900 | 91 | $219,900 | $257,895 |

| Oct 2009 | 765 | $299,900 | 94 | $206,500 | $294,916 |

| Sept 2009 | 807 | $310,000 | 95 | $184,900 | $239,625 |

| Aug 2009 | 864 | $313,000 | 79 | $178,000 | $250,120 |

| July 2009 | 909 | $309,000 | 87 | $225,000 | $280,787 |

| June 2009 | 927 | $310,000 | 79 | $252,000 | $293,661 |

| May 2009 | 902 | $316,000 | 58 | $226,000 | $309,806 |

| April 2009 | 894 | $300,000 | 63 | $205,000 | $243,669 |

| Mar 2009 | 893 | $299,950 | 58 | $177,000 | $287,996 |

| Feb 2009 | 889 | $309,000 | 58 | $215,500 | $293,295 |

| Jan 2009 | 902 | $319,000 | 51 | $220,000 | $272,571 |

| Dec 2008 | 956 | $320,905 | 44 | $242,250 | $348,906 |

| Nov 2008 | 1032 | $325,000 | 50 | $240,287 | $329,953 |

| Oct 2008 | 1078 | $329,000 | 77 | $255,000 | $343,234 |

| Sept 2008 | 1109 | $328,500 | 82 | $224,500 | $266,170 |

| Aug 2008 | 60 | $282,500 | $328,393 | ||

| July 2008 | 63 | $205,000 | $277,250 |

Year to Date Comparison (1/1 – 7/31)

| Year | # of Homes Sold | Median Sales Price | Average Sales Price | Days on Market | List Price to Sales Price |

|---|---|---|---|---|---|

| 2010 | 467 | $190,100 | $247,700 | 125 | 95% |

| 2009 | 454 | $220,000 | $283,180 | 131 | 95% |

| 2008 | 356 | $270,000 | $346,269 | 127 | 94% |

| 2007 | 476 | $317,450 | $422,063 | 120 | 96% |

| 2006 | 663 | $315,000 | $392,281 | 74 | 97% |

| 2005 | 964 | $265,500 | $336,124 | 73 | 98% |

| 2004 | 1022 | $217,750 | $260,348 | 82 | 98% |

| 2003 | 849 | $180,000 | $219,565 | 52 | 98% |

Year-to-Date comparisons – Sales are up 3% from 2009, and 31% from 2008. The median and average prices are down 14% and 13% respectively from 2009, while compared to 2008 – down 30% and 28% respectively.

Prices still look to be in the 2004 range. People are always wondering how the real estate market in Big Bear is doing. And the answer is always, “It depends.” Currently, sales are okay, prices are still down. Compare 2010 to 2003. If someone asked how the market was then, most people would say, “great,” as sales were up but prices were lower than they are today. And today they say, “not great” as sales are much lower even though prices are now higher than 2003 levels. If you’re asking about the market, be sure to know what you are asking about.

Til next month,

Want more? Be sure to sign up for our email newsletter or RSS feed.

* Note: The charts above are updated on a monthly basis. They represent single family home sales in the Big Bear area, including Big Bear Lake, Big Bear City, Moonridge, Fox Farm, Sugarloaf, Erwin Lake, & Fawnskin. Data courtesy of the Big Bear MLS. These numbers do not include raw land or condos nor does it include homes in the Big Bear MLS that are located out of the Big Bear area or home sales not listed in the Big Bear MLS.

Related Articles

Big Bear Home Sales – June 2010 & Second Quarter 2010

Big Bear Home Sales – May 2010

Speak Your Mind