Starting in 2013, there will be a new 3.8% tax that will affect some sellers, not all, of Big Bear real estate.

Starting in 2013, there will be a new 3.8% tax that will affect some sellers, not all, of Big Bear real estate.

There have been a lot of rumors, many of which are not true, flying around the Internet the past few years about a new real estate tax. Contrary to popular belief, this tax will not apply to all home sales. According to the National Association of Realtors (NAR), this new tax will only affect 2-3% of the home sales.

What is the new 3.8% tax law?

The law was passed by Congress in 2010 with the intent of generating an estimated $210 billion to help fund President Barack Obama’s health care and Medicare overhaul plans.

Applies to:

- Individuals with adjusted gross income (AGI) above $200,000

- Couples filing a joint return with more than $250,000 AGI

Types of Income:

- Interest, dividends, rents (less expenses), capital gains (less capital losses)

Formula:

- The new tax applies to the LESSER of

- Investment income amount

- Excess of AGI over the $200,000 or $250,000 amount

Effect on the Big Bear real estate market?

I believe that this new law will affect more than the 2-3% figure that NAR is using. They are basing this on several assumptions: 1. On a principle residence sale, there is a built-in $250,000/$500,000 (single/married) capital gains exception, & NAR thinks it won’t affect many sellers, as very few sellers are realizing a gain more than that in this market; 2. The taxpayer’s adjusted gross income (AGI) needs to be above the $200,000/$250,000 (single/married) threshold. Most Americans will not reach this AGI threshold according to NAR.

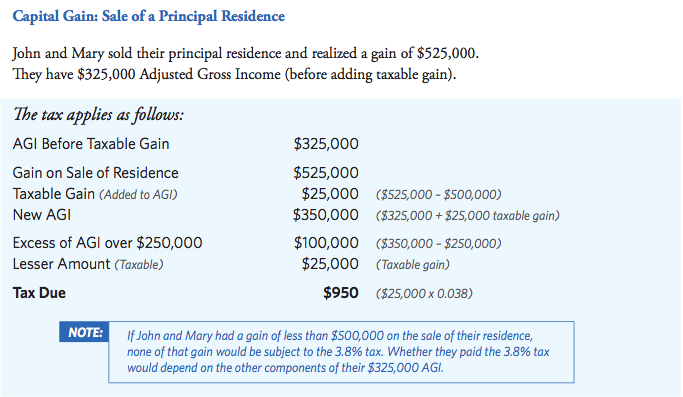

For those who will be affected, take a look at the example from NAR below.

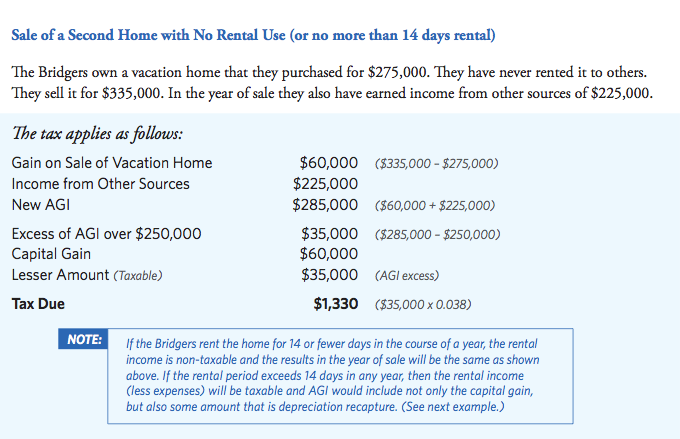

But, with second homes and investment properties, there is no gains exception as with a primary home sale. And close to 75% of the home sales in Big Bear are second homes or investment homes. So, it has the potential to affect more home sales in Big Bear than other areas made up predominantly of primary home sales.

Take a look at this NAR example for a second home sale.

So, a home seller in Big Bear who is selling a second home, has a capital gain, and has an adjusted gross income over $200,000 (single) or $250,000 (married) will be affected. To what degree and how many sellers will fall in this category is anybody’s guess. My opinion is that it will be much higher than the 2-3% NAR mentioned. Even if it is just a small amount of tax, it is still less that will be going in the seller’s pocket.

Here are a few other examples as provided by NAR to help answer questions about the new 3.8% tax –

NAR Handout - Information and Examples of 3.8% tax (6.6 MiB, 507 hits)

NAR Handout - Information and Examples of 3.8% tax (6.6 MiB, 507 hits)

One other important item to note from NAR, “although it takes effect in 2013, any impact on taxes wouldn’t happen until 2014. That’s because the tax filer would do the calculation in 2014 for the 2013 tax year. Because it’s not a tax on a real estate sale but rather on a capital gain, it’s not calculated at the time of an asset sale, whether that asset is a house or something else. It’s calculated at the time the filer figures his or her tax.” This is not a sale tax and point-of-sale tax.

I am not a tax professional. My intent with this post was to clear up some of the confusion and rumors out there. In the end, every Big Bear home seller should talk with their tax professional prior to selling as their situation is always going to be unique, and there are many tax laws and rules already in place that affect non-owner occupied homes.

More reading material on the new tax.

https://speakingofrealestate.blogs.realtor.org/2012/10/09/3-8-tax-whats-true-whats-not/

Speak Your Mind