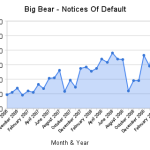

The foreclosure filings for Big Bear (notices of default, notices of trustee sale, and properties that went back to the bank) in April 2009 were down 5% as compared to March 2009. But, they were up 20% when compared to April 2008, or year over year. There were a total of 92 properties in the Big Bear area that received a notice of default in April, which is down 14% from the all-time high we saw in March 2009. Even though there was a decline, 92 is still on the very high end of the range (see the chart below) … [Read more...]

Search Results for: foreclosure

March 2009 – Foreclosure Numbers For The Big Bear Real Estate Market

Notices of Default (NOD) in Big Bear eclipsed the 100 mark for the first time in history during March 2009. Up 13% from the previous high of 95 NODs in February 2009, the new record set in March was 107 NODs. This means more and more properties in the Big Bear area going into default, a majority of which will most likely be bank owned in 6-12 months. While the NODs were up, the Notices of Sale (NOS) and the number on properties that went back to the bank were down. NOSs were down 13% in March, from 68 in … [Read more...]

Big Bear Real Estate Market – Monthly Foreclosure Numbers February 2009

In order to know where we are going as a real estate market, it is important to see where we have been in the past. Without running the numbers and creating the foreclosure charts below, it would be impossible to really forecast what is coming down the pike in Big Bear. That said, the number of notices of default, notices of sale, and properties that went back to the bank in February 2009 were the highest we have seen since the tracking started in October of 2006. What does this mean? We are going to see many … [Read more...]

Short Sales, Foreclosures, & Bank Owned / REO Properties – What’s The Difference?

I received a question last week on Trulia.com asking about the difference between a bank owned property and a foreclosure. These terms can be confusing to those who are not in the business, and even for some of us in the business. Here's a short video explanation of the differences between bank owned properties, foreclosures, and short sales and how they are all related in the end. Feel free to add comments or ask me any questions. [viddler id=6a9e0eb6&w=437&h=368] … [Read more...]

Big Bear Real Estate Market off to solid start in 2020!

Residential sales in Big Bear were up 9% year over year during the first quarter of 2020, while the average sales price was up 6% as per the Big Bear MLS. There were 270 residential sales from January 1, 2020 to March 31, 2020 vs. 247 sales during the same time last year. The average sales price rose from $364,000 in 2019 to $386,000 in 2020. The average days on market went up a modest 11 days year or year. Given all of the craziness with COVID, it's important to note that the Big Bear real … [Read more...]

Big Bear Real Estate News

In our digital economy, international, national and local economies affect our marketplace. As we keep our eye on China, the Euro, the unemployment rate and other leading indicators, the news seems to show an upswing in several economic factors. On the international scene, China’s lifting of some controls is the strongest sign that the government intends to change; according to the New York Times. Some have called the restructuring a symbolic move. But, since it signals a broader acceptance of western banking … [Read more...]

Big Bear’s Service Groups

For what can be considered a small area, Big Bear Lake offers a large variety of clubs and organizations offering opportunities to serve, extend your education, and meet and enjoy the company of others with similar interests. To pique your interest, here is a short list of some of the service organizations active in Big Bear. American Legion Post 584 Bear Valley Community Hospital District Foundation Big Bear Airport Pilots Association Big Bear Association of Realtors Big Bear Bridge Club Big Bear Chapter of … [Read more...]

Real Estate Appraisals

The Big Bear real estate market isn’t immune to market fluctuations and many sellers are finding themselves in an unhappy but common predicament. They may be in escrow with a qualified buyer but the financing has now fallen through because the appraisal has come in at less than the agreed upon price of the home. This has led to a high number of contract cancellations. The increase in contract cancellations or delays has been blamed on more lenders declining mortgage applications from stricter underwriting … [Read more...]

Types of Home Loans

The dictionary defines mortgage, as “a conveyance of or lien against property (as for securing a loan) that becomes void upon payment or performance according to stipulated terms”. There are many features to consider when securing a home loan. You’ll want to consider the size of the mortgage, method of repayment, interest rate and maturity of the loan. Fixed Rate Mortgage 75% of all mortgages are fixed rate, it’s the mainstay of the home loan industry. They’re popular because they’re predictable. Borrowers … [Read more...]

Local Real Estate – Fixer-uppers

Wikipedia defines a fixer-upper as a “real estate property that will require maintenance or work, though it can be usually lived in as is.” If you’re in love with old homes, the idea can be irresistible. Advantages: Purchase a home in a good neighborhood at a lower price Increase the net worth of your investment Here are our suggestions: 1. Do the math first. Add up the expected expenses of renovation, accurately reflecting the cost of materials and labor. Then subtract the expected value. Experts from the … [Read more...]