Are you gearing up to buy a Big Bear home? Now is a great time to make a move in the local real estate market. First of all, interest rates are at historic lows. Compare today's 30-year fixed-rate average of between 3 and 4 percent to the 13 to 18 percent rates of the 1980's. This gives buyers more purchasing power as current interest rates equate to lower monthly mortgage payments. Additionally, homes are now at their most affordable on record. This is because home values have dropped considerably in the past few … [Read more...]

Interest Rates May Have Bottomed Out

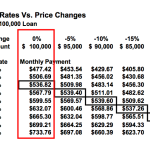

The Big Bear real estate market has been picking up steam lately thanks to the correction in home prices and historic low interest rates. And while many potential home buyers have been waiting on the sidelines for an indication that the market has bottomed out, the recent up-tick in interest rates may be signaling that the time to buy a Big Bear home or investment property is NOW. The most recent “Primary Mortgage Market Survey” by Freddie Mac reports that fixed mortgage rates moved higher following stronger … [Read more...]

Explaining What The Federal Reserve Did In Plain English (January 28, 2009 Edition)

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged today. It remains within a target range of 0.000-0.250 percent. In its press release, the FOMC reiterated most of the key points from its December 2008 statement, including: The U.S. employment outlook continues to deteriorate Consumers and businesses continue to cut spending The housing sector is still showing weakness In addition, the FOMC addressed the "extremely tight" credit conditions for U.S. households and business, even as … [Read more...]