Bank repossessions in Big Bear were up 9% in September though the overall foreclosure filings dropped significantly. The foreclosure filings in September 2009 (180) were down 18% from August 2009 (219). Year over year, however, filings were up 122% from the September 2008 (81) numbers. Good news - we are seeing a slow down in the foreclosure numbers. Bad news - the numbers are still too high to be overly excited about the market getting better. Foreclosure filings are made up of three parts - Notices of … [Read more...]

Should I Price It Firm Or Flexible?

This question inevitably comes up every time when I am talking with sellers about their asking price. And the most common statements or questions I hear relating to this are - "We don't want to give it away" "Let's start higher, we can always go down, can't go up." "Buyers are going to want to low-ball the price, so why not leave some room?" My recommendation to sellers is always to price firm, regardless. I understand not wanting to give it away. In fact, I've never met a seller that wants to give their … [Read more...]

Big Bear Home Sales – September 2009 & Third Quarter 2009

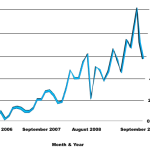

Big Bear Home Sales In typical fashion for today's volatile real estate market, September home sales in Big Bear hit a 2 year high with 92 homes sold. Home sales rose 19% when compared to the August numbers (92 v. 77), and were up 12% when compared to September 2008 (92 v. 82). The peak selling season is July thru October so increased sales are not to be unexpected during this time frame. But, the last 4 months have also been the strongest stretch we've seen in quite a while. I believe this increase in sales … [Read more...]

Big Bear Foreclosure Numbers – August 2009

Foreclosure numbers in Big Bear slowed a bit in August though they still remain near record highs. The foreclosure filings in August 2009 (219) were down 10% from July 2009 (244), but were still up 27% from August 2008 (173). Foreclosure filings are made up of Notices of Default, a recorded document that starts the foreclosure process, Notices of Sale, a recorded document that sets the date for the Trustee Sale, and lastly, Trustee Sales, properties that go back to the bank or sold to third parties. Here's how … [Read more...]

Is The Big Bear Real Estate Market Headed Toward The Perfect Storm?

I believe it could be. The current state of the real estate market in Big Bear reminds me of a scene in the movie, "The Perfect Storm". Near the end of the movie, after the fishing boat and its crew battle huge waves and horrible weather, things clear up. They think they made it through. But, the storm comes right back even stronger and eventually sinks the ship & crew. This is similar to the current state of the real estate market in Bear. We've seen rough waters over the past 2-3 years, and things … [Read more...]

My First Blog Post

Testing posterous, please indulge … [Read more...]

My First Blog Post

Just signed up for my posterous account … [Read more...]

Big Bear Home Sales – August 2009

Big Bear Home Sales Big Bear home sales dropped in August from the 2-year high we saw in July. Home sales fell 14% when compared to the July numbers (75 v. 87), but were up 25% when compared to August 2008 (75 v. 60). Even with the drop in sales month over month, sales are still pretty strong all things considered. They are certainly not close to the sales numbers we saw 4-7 ago (averaging about 175 per month). It is typical to see sales pick up in the June to October time frames as that is our selling … [Read more...]